Poor Web Content = Missed Opportunities

I was talking with a banker friend at Crossfit this week during my usual 6am workout, and he began asking me questions about what we do at EVG. I briefly explained about our content marketing services and why companies hire us to help them deal with the complexities of keeping their web content up to date. He then offered an unexpected observation:

“You know, in our bank, before we ever pull a credit score on a company we check out their website to see if it’s up to date and looks sophisticated. If it’s not then we are less interested in doing business with them because they are probably not a growing business”

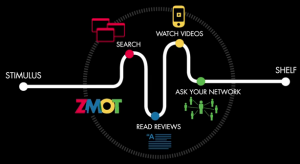

Because we’ve spent a lot of time at EVG over the last few years understanding user behavior, especially with regard to ZMOT — that key moment in the buying process when a consumer conducts online research to learn about products and inform his/her purchase decision — this really got my attention. I asked if this was a new practice or bank policy. He responded that it wasn’t a hard and fast policy, but that all of the commercial lenders in his group routinely do this now and didn’t in the p ast.

ast.

I certainly can’t make a claim that all banks make lending decisions based on a poor web content or online effectiveness, but I would make a bet that many consider it and form a first impression based on what they find online before they ever meet the client face to face. In this digital age, your website — really, your web presence — and the content you put there is as much your introduction to the public at-large as is, say, your lobby or retail location. Is it neat and orderly? Is it up-to-date? Does it present the brand in a way that is compelling, even likable? And the million-dollar question: If it’s not any of these things, do I risk losing both both revenue and investment opportunities?

There are also some great studies that indicate 70% of today’s buyers research a company or product online before they ever make contact with them in person — again, that’s ZMOT rearing its head. So maybe we all need to ask ourselves: what do our bankers, customers, shareholders, etc. find out about our companies before they ever call us?

Brice Bay – CEO